Decrease in Payables Cash Flow

Finance questions and answers. While increase in current assets and decrease in current liabilities are.

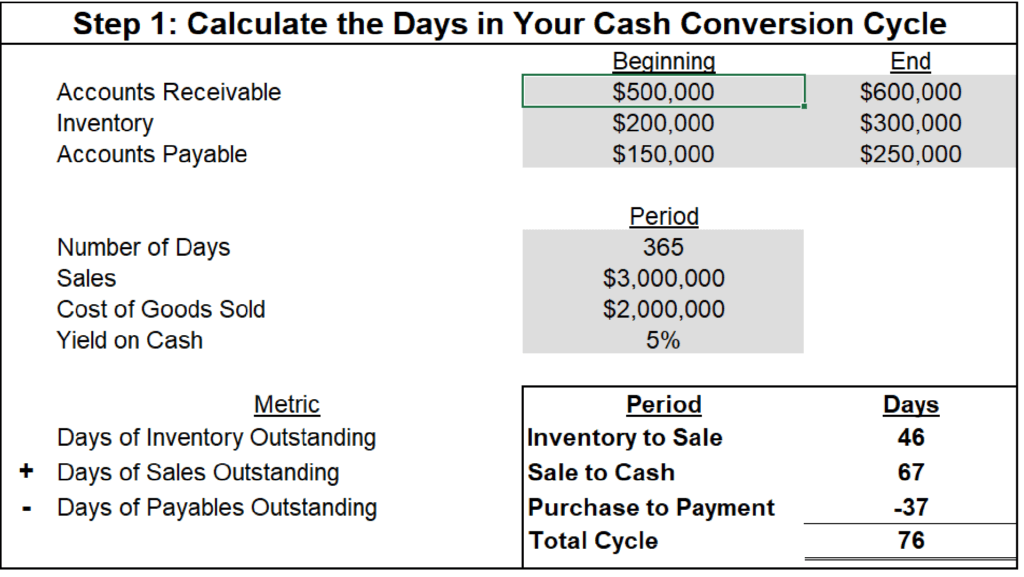

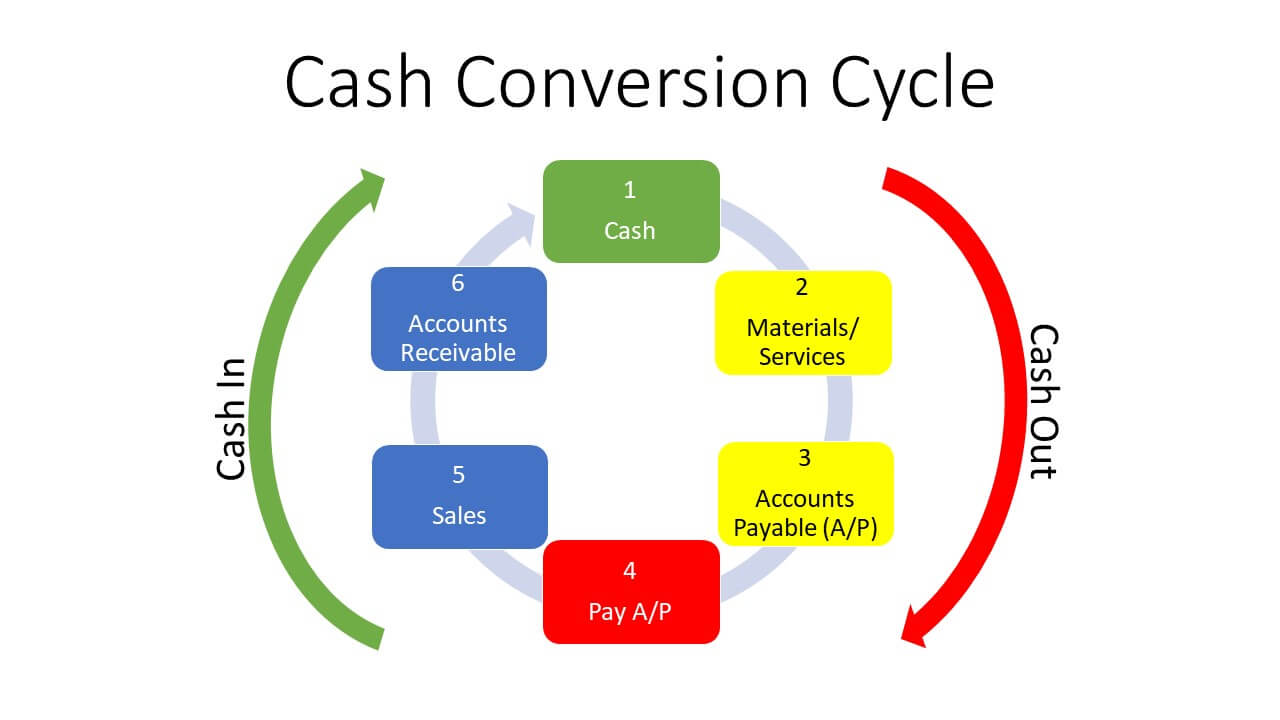

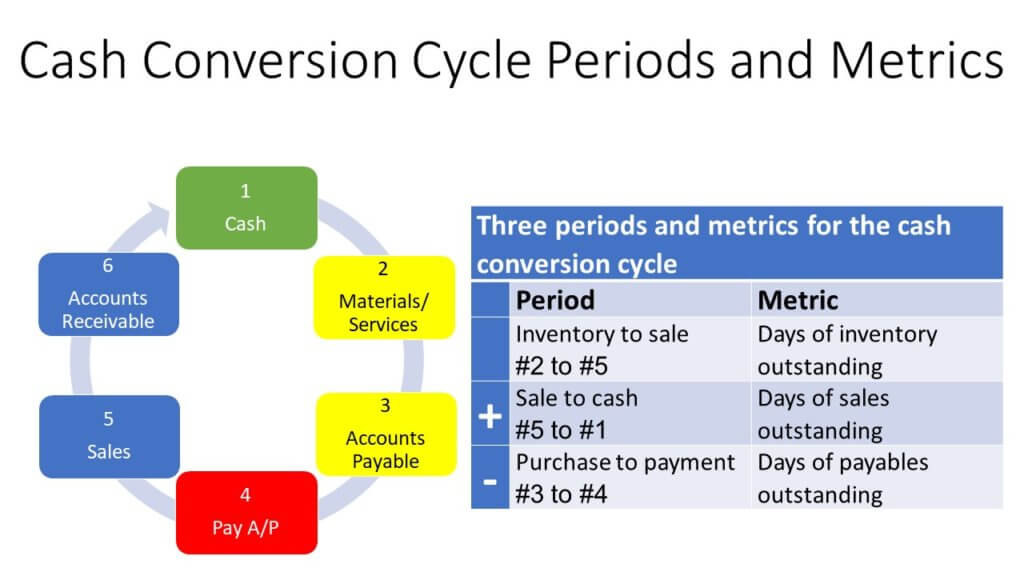

The Short Cash Cycle How To Cut Crunches And Grab More Growth

A decrease in accounts payable represents that cash has actually been paid to.

. The opposite holds true for a decrease in accounts payable. Accounts payable sit in companys balance sheet for the simple reason that cash was not paid but is owed. According to the statement of cash flows a decrease in.

Up to 10 cash back Most businesses prepare an accounts payable aging schedule at the end of each month. Increase in Account Payable 35000. So it means that there are net amount credit sales for which we have not received any cash amount.

A decrease in trade payables occurs when cash paid to suppliers is greater than cash and credit purchases. The Business Cash Flow Tool can help to forecast the impact. Under Indirect method we add back the decrease in current assets and increase in current liabilities.

A typical accounts payable aging schedule consists of 6. It represents the current liability on the balance sheet and operating activity on the cash flow. A decrease in accounts payable does not lower net income.

Accounts payable is the sum of money owed to suppliers and creditors by a business. You can use this information to improve the operation of your. Understanding Accounts Payable AP A companys total accounts payable balance at a specific point in time will appear on its balance sheet under the current liabilities.

Dont override it just because youre the boss. An Increase in Accounts Payable is Favorable for a Companys Cash Balance It may help to view the positive amounts on the SCF as being favorable or good for a companys cash balance. Managing accounts payable to improve cash flow.

Decrease in trade payables. Impact of a decrease in Current Liabilities. For this reason a decrease in accounts payable indicates negative cash flow.

Companies may list a decrease and an increase in accounts payable. Answer 1 of 7. If you find a decrease in the days payable outstanding your.

Typical example would be vendor supplying goods on credit to a. Different terms for accounts payables are agreed upon by different vendors. To calculate it multiply the days in the period by the ratio of accounts payable to the cost of revenues within the same period.

Rather income being what it is a decrease in accounts payable lowers cash. These accounts payables may be payable in 30 60 or 90 days depending on the creditability of the company. Account Payable 35000-70000.

The reason for this is that you have to pay cash to. The larger cash payments have been. Notes payable also called promissory notes are statements promising that one party will pay a set amount to the other party according to agreed-upon terms.

Understanding your biggest uses of cash is the first step in aligning your spending with your true needs. A decrease in accounts payable will also represent a decrease in a companys statement of cash flows. Use e-signature platforms and take advantage of the document management modules offered by your accounting software.

Do Bond Purchases And Sales Appear On The Cash Flow Statement Quora

Cash Flows From Operating Activities Indirect Method Youtube

The Short Cash Cycle How To Cut Crunches And Grab More Growth

The Short Cash Cycle How To Cut Crunches And Grab More Growth

Comments

Post a Comment